Snapchat has published its latest performance report, which, in the topline results at least, shows steady increases in users and revenue, as it continues to refine its business offerings, and capitalize on its market opportunities.

Though growth in key markets remains a challenge, with Snap continuing to lose users in the North American market, its key revenue source, while rising costs also continue to weigh on its overall results.

And its revenue results are also not great.

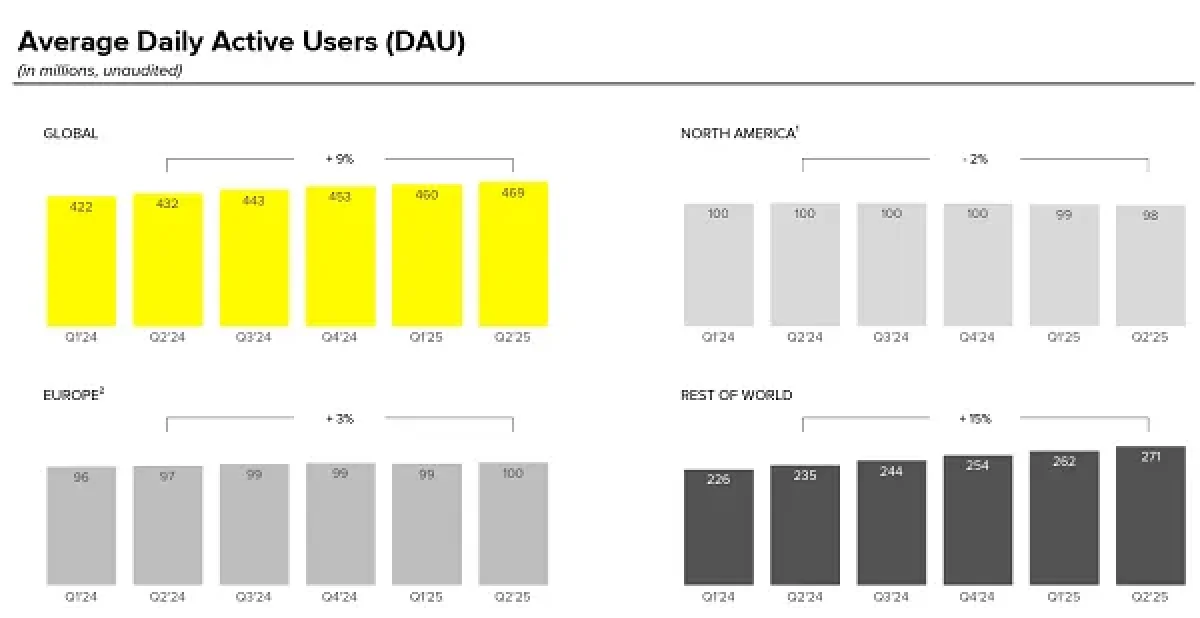

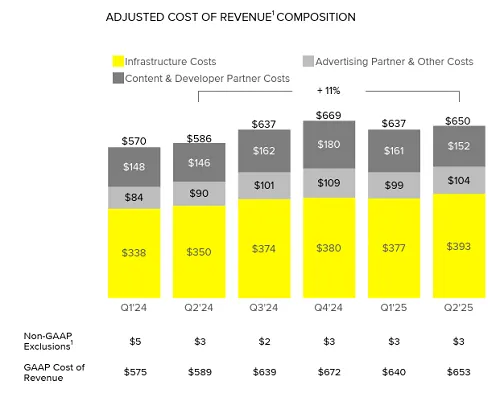

First off, on users. Snapchat reached 469 million daily active users in Q2, an increase of 9 million on its Q1 numbers.

Again, any growth is a positive, but the fact that Snap is losing users in the U.S. is a standout note from this chart. Almost all of Snap’s growth is still coming from the “Rest of World” category, with India in particular seeing more take-up. But the U.S. and EU is where Snap generates the majority of its revenue, and as such, the stagnant results here are potentially problematic.

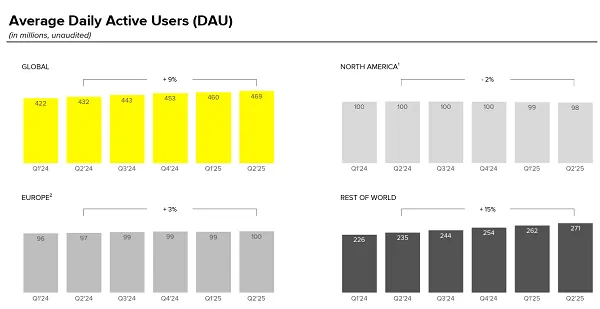

As you can see in these charts, Snap generates almost 4x more revenue per user from its North American audience, and 800% more than those in the “Rest of World” segment.

Building in more markets obviously bodes well for future opportunities, as these regions continue to develop their digital economies. But the steady decline of Snap usage in the U.S. points to a plateau, and a potential cap on Snap’s growth.

But of course, Snap’s keen to focus on the positives, with the platform also inching closer to a billion monthly actives, with 932 million monthly active users (MAU), an increase of 32 million on Q1.

And overall, the fact that Snap is still adding millions more users is an indicator of its enduring relevance and resonance, particularly among younger users.

We’ll see how the market responds to such.

On the revenue front, Snap brought in $1.3 billion for the quarter, an increase of 9% year-over-year.

But again, you can see the impact of its U.S. audience decline here, with its North American revenue down on Q1, while it’s also posted its lowest revenue result in four quarters.

And while Snap is focused on its next-level bets, like AR glasses, it needs to keep generating revenue to maximize this element, and the chart trends here don’t look great.

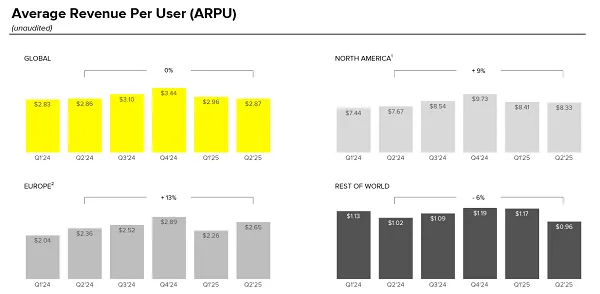

Including this one:

In terms of specific business offerings, Snap says that it’s seeing good results with Sponsored Snaps, which are now driving an 18% lift in unique conversions across app installs and app purchases.

Snap says that it’s also seeing more engagement with its Spotlight short-form video offering, with time spent in the Spotlight feed rising 23% year-over-year, facilitating more exposure options. Indeed, Snap says that Spotlight now contributes more than 40% of total content time spent in the app, which could be worth noting for your video ads.

Snap’s also been working to integrate more creator content, via its Snap Stars program, with the number of Spotlight posts by Snap Stars growing more than 145% year-over-year in North America in Q2.

So there are, at least in theory, opportunities there, and if Snap can facilitate more brand partnerships, leading to creator monetization and increased exposure potential for brands, there will still be value on this front, even if overall usage dips.

Snap also notes that use of its Snap Map has grown to more than 400 million MAU, and with expanded promotional options being integrated here, that could be another area of opportunity.

But it’s Snapchat’s AR project, and the costs associated with it, that remain a point of contention.

Back in June, Snapchat announced that it’ll release its AR-enabled Spectacles next year, in an effort to beat Meta to market with a functional, fashionable AR device.

Which makes sense, as the indicators are that Meta’s glasses will be more functional, fashionable and cheaper, but the cost of that project is likely a significant contributor to Snap’s increasing infrastructure costs, along with its own AI projects.

But Snap’s not building its own AI tools, it’s mostly hosting AI experiences from OpenAI and Google, in order to power things like its “My AI” chatbot. As such, the majority of its costs would likely be going towards this AR glasses push, which makes sense in the broader scale of Snap’s long-term plan.

But in practice, it seems like this could be a disaster for the business.

Sure, Snap users are still interested in AR, with Snap reporting that more than 350 million Snapchatters now engage with its AR tools every day, and Snap continues to add more innovative AR uses, like its recent integration with a TV show in the U.K.

But will they also buy Snap’s AR glasses, and if they do, will Snap be able to maintain momentum for such as Meta continues to inch closer to a launch of its AR device.

I don’t think that this is a race Snap can win, and Snap might be better off developing AR experiences for other devices, as opposed to investing in its own, which is looking like a major cash drain, for what may well be only a short-term boost in interest.

Snap’s net loss for Q2 was $263 million, compared to $249 million in the prior year. And as the costs continue to rise, and user growth remains a question, this seems like a big point of concern for the app.